child care tax credit 2020

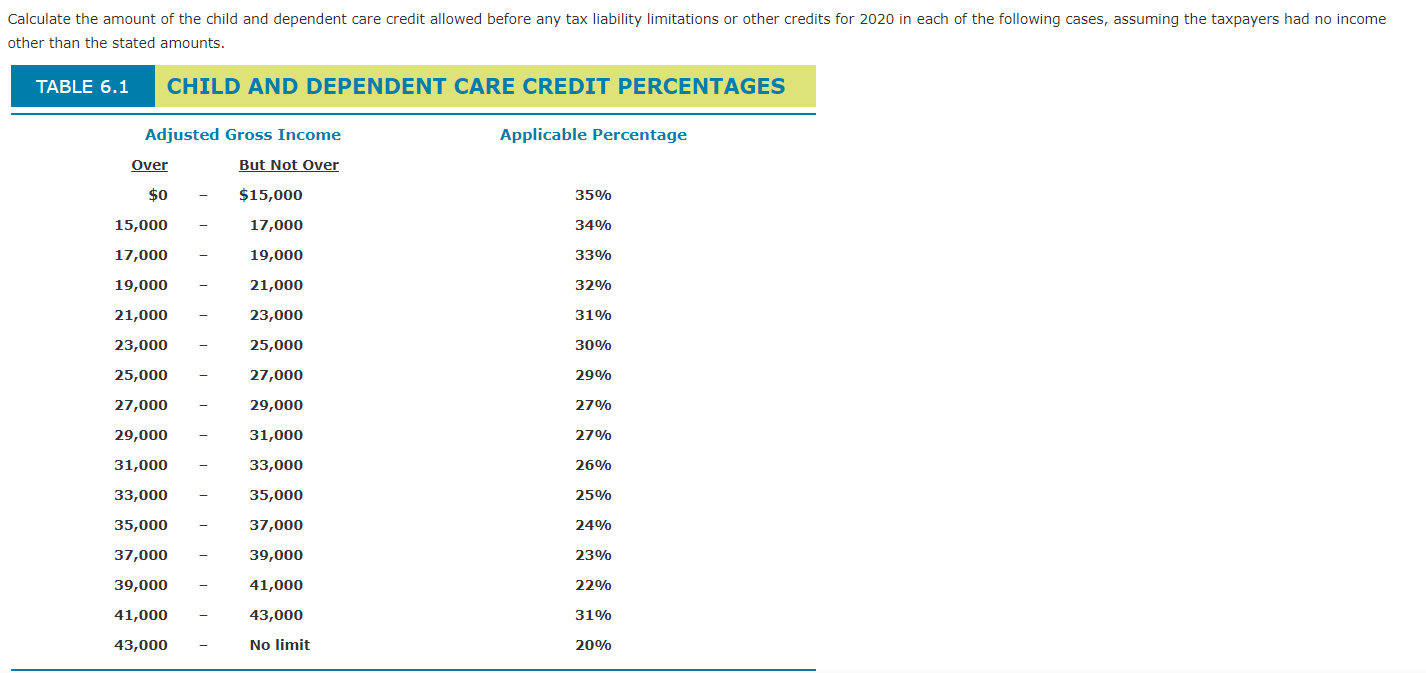

Below the calculator find important information regarding the 2020 Child and Dependent Care Credit CDCC. The taxpayer had not included the payment in income following Notice 2014-7 but.

New Info On The Child Care Tax Credit Ncca

In this case the taxpayer had received a W-2 reporting such a difficulty care payments.

. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. Energy Assistance Programs DCA.

Earned Income Tax Credit. In addition to babysitting children the past five years she has worked with infants and. If your system was installed between 2006.

A taxpayer who makes a monetary contribution prior to January 1 2020 to promote child care in the state is allowed an income tax credit that is equal to 50 of the total value of the. This credit has been greatly changed as part of. The credit will reduce the amount of New.

Community Coordinated Child Care 225 Long Avenue Bldg 15. Amilly is currently working at a school has babysat regularly for a few families. The credit is calculated.

600 in December 2020January 2021. 1200 in April 2020. Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021.

Emergency Assistance General Assistance End Hunger NJ. The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons. Up to 8000 for two or more qualifying people.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Information on how to claim the 2020 Child and Dependent Care Credit can be found on page 34 of the 2020 NJ-1040 Instructions. If your solar panels were installed after January 1 2022 you may qualify for the newly increased 30 tax credit under the Inflation Reduction Act.

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

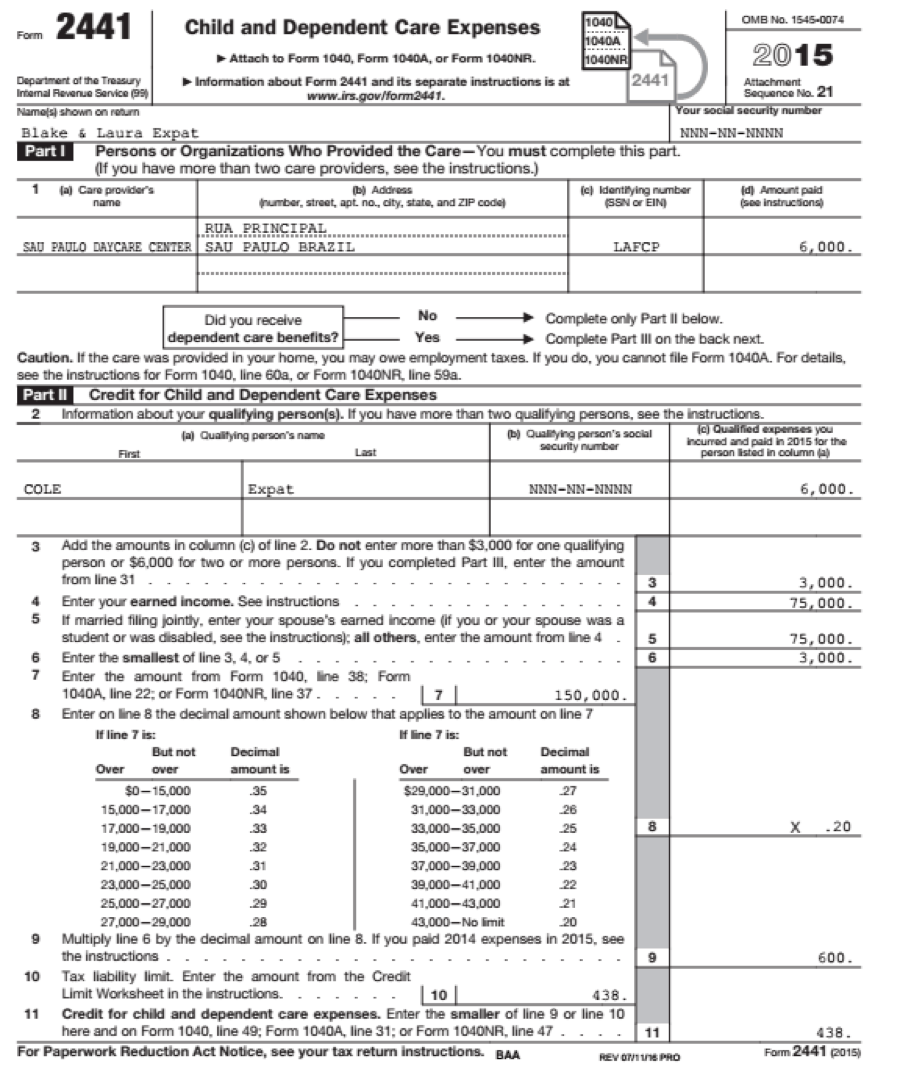

The Child Care Credit And Your Us Expat Tax Return When Abroad

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Child And Dependent Care Credit H R Block

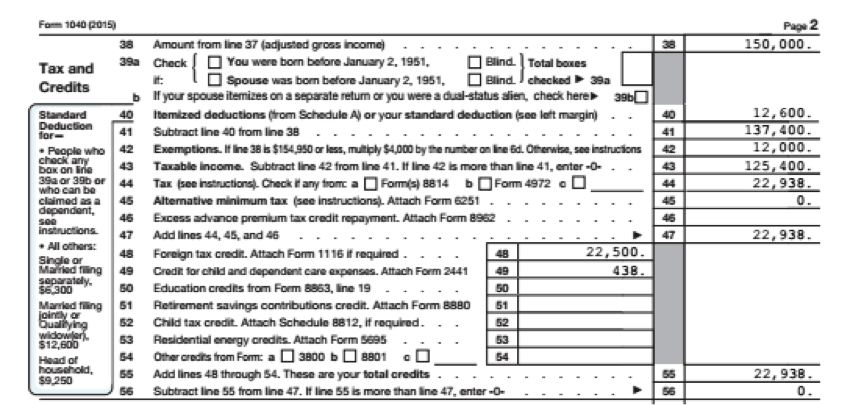

Solved Calculate The Amount Of The Child And Dependent Care Chegg Com

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Some D C Lawmakers Are Asking If Every Family Should Get A Child Care Tax Credit Wamu

What The New Child Tax Credit Means For Pa Whyy

The New Child Tax Credit Does More Than Just Cut Poverty

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return Kiplinger

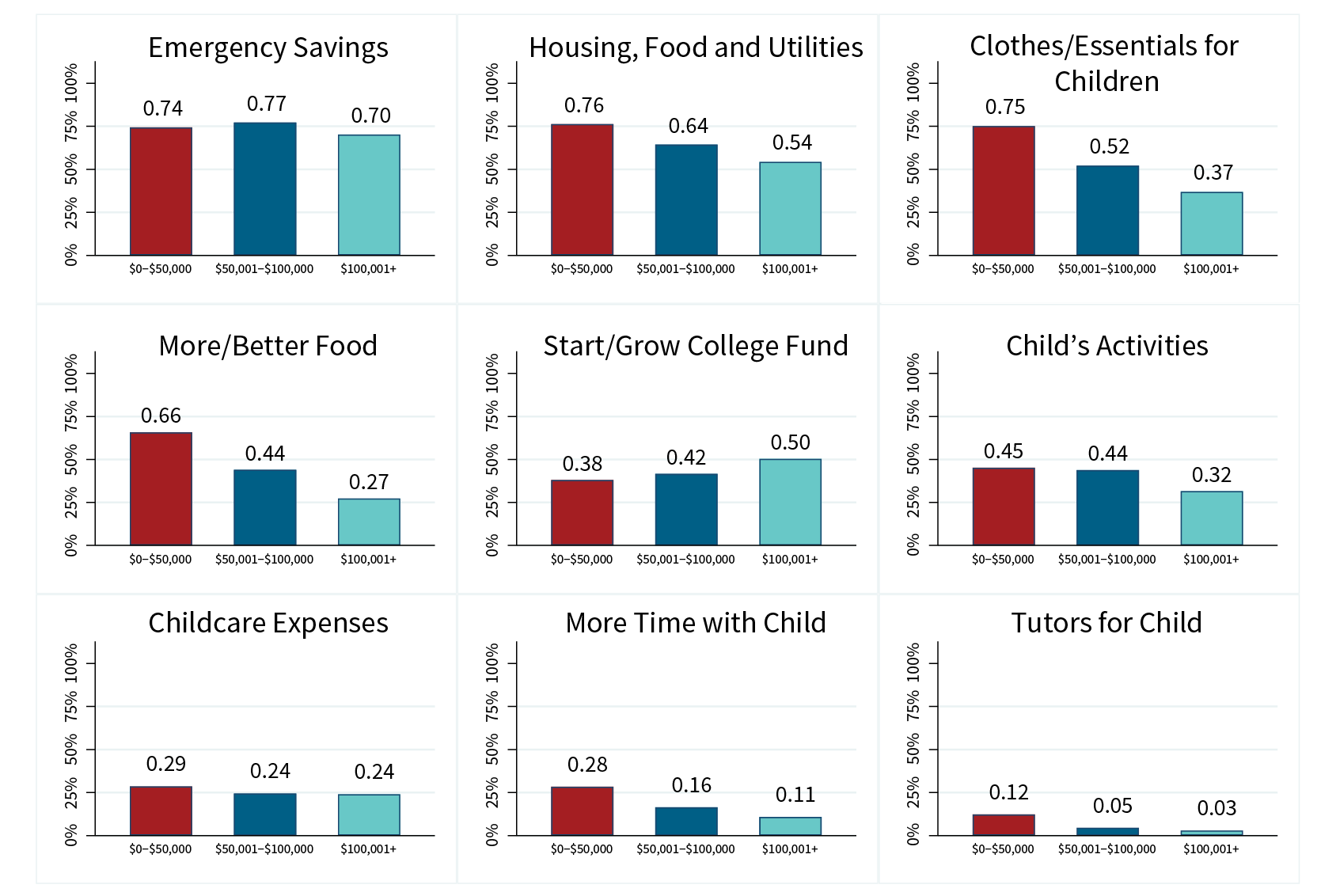

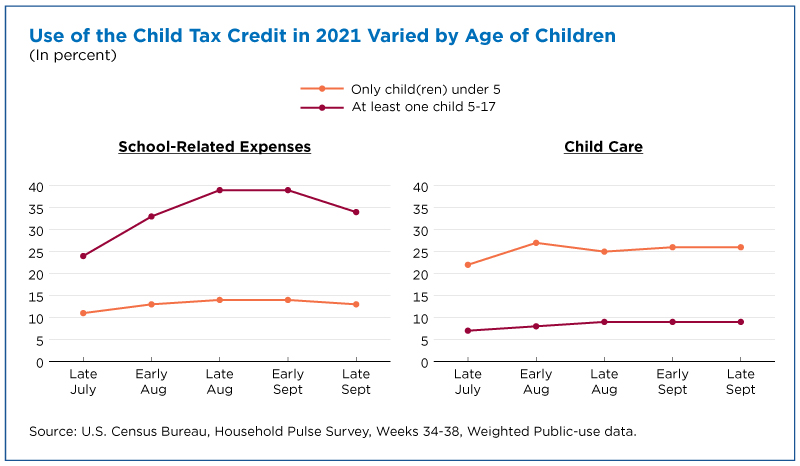

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

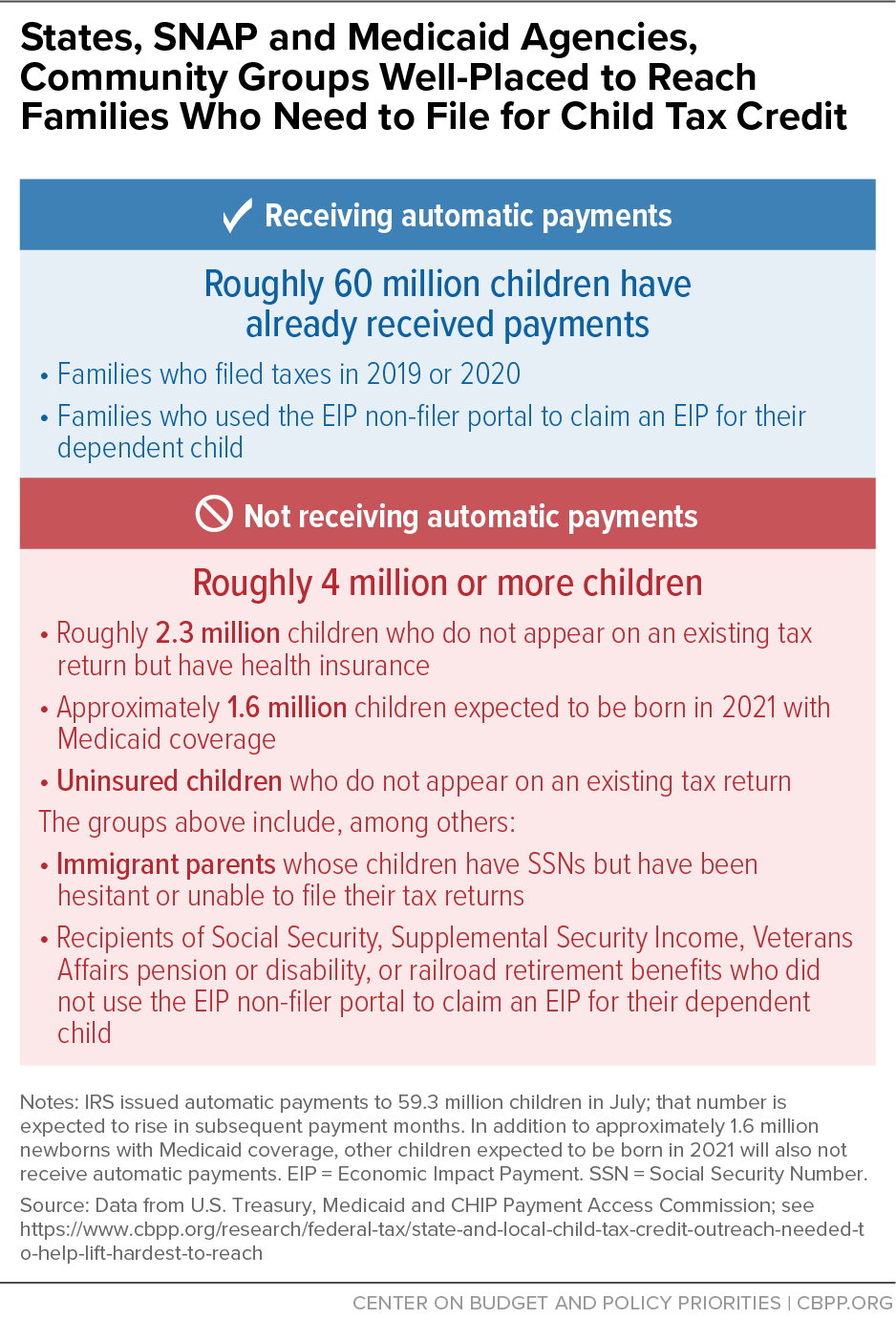

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

The Child Tax Credit Research Analysis Learn More About The Ctc

Don T Miss Out On Child Tax Credits Community Legal Aid Society Inc

The Child Tax Credit Research Analysis Learn More About The Ctc

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Care Tax Credit Can End No Win Choice For Working Parents The Hill

The Child Care Credit And Your Us Expat Tax Return When Abroad